It’s safe to assume that car insurance companies want to keep your business as long as possible. Insureds who rate shop once a year will, in all likelihood, buy a different policy because there is a high probability of finding coverage at a cheaper rate. A recent survey discovered that consumers who did price comparisons regularly saved an average of $850 each year as compared to drivers who never compared rates.

If saving money on insurance in Detroit is your objective, learning how to shop and compare car insurance can help make the process easier and more efficient.

If you want to save the most money, the best way to get low-cost auto insurance rates in Detroit is to compare prices annually from insurers that sell auto insurance in Michigan.

If you want to save the most money, the best way to get low-cost auto insurance rates in Detroit is to compare prices annually from insurers that sell auto insurance in Michigan.

- Try to comprehend what is in your policy and the steps you can take to prevent expensive coverage. Many risk factors that cause high rates such as getting speeding tickets and your credit history can be rectified by improving your driving habits or financial responsibility.

- Compare price quotes from exclusive agents, independent agents, and direct providers. Exclusive and direct companies can provide rates from a single company like Progressive or Farmers Insurance, while independent agencies can provide rate quotes from many different companies.

- Compare the new rate quotes to your existing rates to determine if you can save on 2 insurance. If you find a lower rate, make sure the effective date of the new policy is the same as the expiration date of the old one.

A crucial key to this process is that you’ll want to make sure you compare identical coverage information on every quote and and to get quotes from as many different companies as possible. This guarantees a fair price comparison and a good representation of prices.

Choosing the best rates in Detroit is easy if you know what you’re doing. If you have a current insurance policy or just want to save money, you can use these techniques to save money and still have adequate protection. Smart buyers only need an understanding of how to compare rates online.

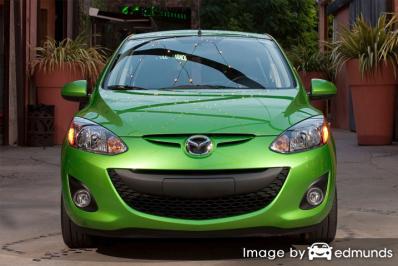

How to buy Mazda 2 insurance online

Most major insurance companies give coverage prices from their websites. Doing online quotes for Mazda 2 insurance in Detroit doesn’t take much effort as all you need to do is type in your coverage preferences into the quote form. Once entered, the quote system will order your credit score and driving record and generates a price based on these factors. The ability to get online rate quotes for Mazda 2 insurance in Detroit makes comparing rates easy, and it’s very important to have as many quotes as possible if you want to get the best possible rates on auto insurance.

To compare pricing, compare rate quotes from the providers shown below. If you have coverage now, it’s recommended you replicate the limits and deductibles identical to your current policy. This guarantees you are getting rate quotes based on similar coverages.

The companies in the list below have been selected to offer price quotes in Michigan. If your goal is to find cheap auto insurance in Detroit, we recommend you click on several of them in order to get a fair rate comparison.

Mazda 2 insurance discounts in Detroit

Insurance is not an enjoyable expense, but there could be significant discounts that you may not even know about. A few discounts will be applied at quote time, but lesser-known reductions have to be manually applied prior to getting the savings.

- Discounts for Safe Drivers – Insureds who avoid accidents can save as much as half off their rates compared to rates paid by drivers with frequent claims.

- Multiple Policy Discount – If you can bundle your home and auto insurance and insure them with the same company you will save up to 20% and get you the cheapest Mazda 2 insurance in Detroit.

- Online Discount – Some of the larger companies may give you up to $50 for buying your policy on the web.

- New Car Discount – Buying a new car instead of a used 2 can get you a discount since newer models are generally safer.

- Driver Safety – Passing a defensive driving course could cut 5% off your bill depending on where you live.

- Good Students Pay Less – Performing well in school can get you a discount of up to 25%. The discount lasts until age 25.

- Waiver for an Accident – This isn’t a discount exactly, but some insurance companies will forgive one accident before raising your premiums if you are claim-free for a certain period of time.

Discounts lower rates, but most discount credits are not given to all coverage premiums. The majority will only reduce individual premiums such as physical damage coverage or medical payments. Just because you may think all those discounts means the company will pay you, you’re out of luck. But all discounts will definitely reduce your overall premium however.

A list of companies and their offered discounts are shown below.

- State Farm includes discounts for accident-free, multiple autos, anti-theft, good student, and student away at school.

- Esurance may include discounts for multi-policy, homeowner, defensive driver, Pac-12 alumni, and claim free.

- Progressive discounts include good student, multi-vehicle, continuous coverage, online signing, and multi-policy.

- Liberty Mutual policyholders can earn discounts including new graduate, new move discount, safety features, preferred payment discount, good student, teen driver discount, and exclusive group savings.

- Auto-Owners Insurance offers discounts including mature driver, paid in full, anti-theft, multi-policy, and good student.

- GEICO has discounts for anti-lock brakes, air bags, multi-policy, daytime running lights, and five-year accident-free.

If you need lower rates, check with all companies you are considering to apply every possible discount. Some of the earlier mentioned discounts may not be offered everywhere. To find providers that offer discounts in Detroit, click here to view.

Insurance is not optional

Even though it’s not necessarily cheap to insure a Mazda in Detroit, paying for insurance may be mandatory for several reasons.

- The majority of states have mandatory liability insurance requirements which means the state requires a specific level of liability coverage if you drive a vehicle. In Michigan these limits are 20/40/10 which means you must have $20,000 of bodily injury coverage per person, $40,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If your 2 has a lienholder, it’s guaranteed your bank will stipulate that you have physical damage coverage to ensure loan repayment if the vehicle is totaled. If you do not keep the policy in force, the lender will be forced to insure your Mazda at a much higher rate and require you to fork over the higher premium.

- Insurance protects both your Mazda 2 and your personal assets. It will also pay for medical bills that are the result of an accident. As part of your policy, liability insurance also covers all legal expenses up to the policy limit in the event you are sued. If mother nature or an accident damages your car, comprehensive and collision coverage will cover the repair costs.

The benefits of buying insurance outweigh the cost, especially with large liability claims. But the average American driver is overpaying more than $865 each year so it’s very important to do a rate comparison every year to be sure current rates are still competitive.

Compare prices but work with a neighborhood Detroit auto insurance agent

Many people would prefer to buy from a local agent and that is recommended in a lot of cases Professional agents can answer important questions and help in the event of a claim. One of the best bonuses of getting online price quotes is that you can obtain cheap rate quotes but still work with a licensed agent.

By using this short form, your information is emailed to participating agents in Detroit that can give you free Detroit car insurance quotes for your insurance coverage. You won’t even need to contact any agents due to the fact that quote results will go to you. If you wish to get a comparison quote from a particular provider, feel free to go to their quote page and fill out their quote form.

By using this short form, your information is emailed to participating agents in Detroit that can give you free Detroit car insurance quotes for your insurance coverage. You won’t even need to contact any agents due to the fact that quote results will go to you. If you wish to get a comparison quote from a particular provider, feel free to go to their quote page and fill out their quote form.

Finding the right insurer should depend on more than just the premium amount. These are some questions your agent should answer.

- How experienced are they in personal risk management?

- What insurance company do they write the most business with?

- What insurance companies do they recommend if they are an independent agent?

- Which companies can they place coverage with?

- Are they actively involved in the community?

- How does the company pay claims for a total loss?

- Who are their largest clients?